Congratulations to Resupply for having a successful rollout and recently transitioning ownership to an onchain voter contract! To celebrate its transition to DAO governance, we are happy to make the first formal proposal to onboard a new market to Resupply.

Summary

Add the sUSDS-long LlamaLend market with vault address 0xc33aa628b10655B36Eaa7ee880D6Bc4789dD2289, allowing users to mint reUSD and leverage supply to the market.

Set market with max 95% LTV, 5% liquidation fee, and 25m reUSD max borrow, consistent with previously onboarded YBS markets.

Abstract

- LlamaRisk has recognized yieldbearing stablecoin markets have attracted the most organic demand across LlamaLend markets and there is an opportunity to onboard additional markets within this category.

- LlamaRisk has identified sUSDS as a candidate to be onboarded as collateral in Curve’s Lending Market. It has successfully undergone a gauge vote to receive CRV emissions.

- In this post we will first present metrics showing the performance of this yield-bearing stablecoin asset since its deployment.

- Finally, we explain the configuration of the sUSDS market and implications for users, including integrating protocols such as Resupply.

Motivation: sUSDS Performance

sUSDS was launched in 2024 as yield-bearing stablecoin asset to supplement their USDS stablecoin.

Sky (formerly Maker DAO) previously offered sDAI as a yield-bearing asset, where DAI was staked to obtain sDAI. USDS is meant to be an upgradeable stablecoin asset that would better suit Sky’s business needs.

sUSDS was released by Sky to give USDS holders an option to opt into a yield-bearing strategy. The smart contract which mints and burns this asset is an ERC4626 vault which accepts USDS as the deposit asset.

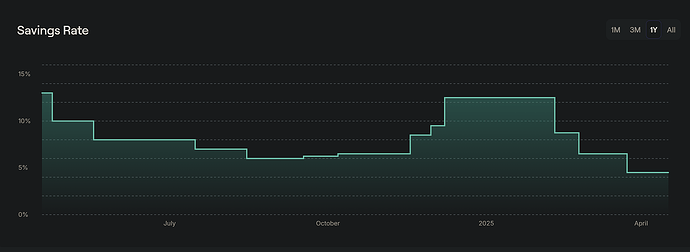

Depositors enjoys a yield which is determined by a preset Sky Savings Rate (SSR) which is set by Sky governance.

Historical SSR for sUSDS, source: Spark

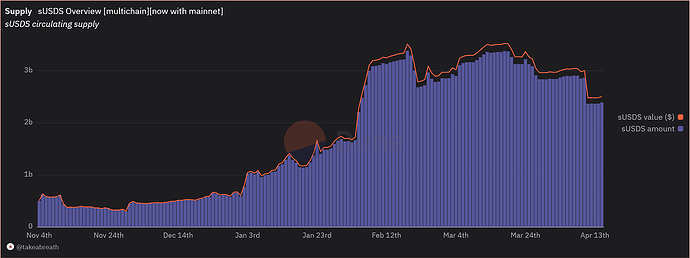

Since it was deployed on September 2024, the stablecoin has enjoyed rapid adoption. On Mainnet, which is where the sUSDS LlamaLend market is also deployed, there is currently ~3B sUSDS in circulation at a market cap of ~$3.16B.

Source: Dune

It is also currently the yield-bearing stablecoin asset with the most TVL on mainnet, recently edging out sUSDe, Ethena’s yield-bearing stablecoin asset, which has ~$2.2B TVL on mainnet. USDS is also distinguished as the third stablecoin by market cap, following USDT and USDC.

Source: Dune

Market Configuration

Parameters

The following parameter set is used for the sUSDS market on LlamaLend:

| Parameter | Value |

|---|---|

| A | 300 |

| Fee | 0.2% |

| Loan Discount | 1.3% |

| Liquidation Discount | 1.0% |

| Min Rate | 0.1% |

| Max Rate | 25% |

This configuration is consistent with other yieldbearing stablecoin markets, offering borrowers an exceptional 51x max leverage thanks to the non-volatile properties of the collateral and additional protection offered by the soft liquidation feature.

The interest rate model is set with a high enough max rate to ensure liquidity for lenders in normal market conditions. In case sUSDS were to experience a period of exceptional APR, the rates can be adjusted with a one week delay on execution. It is worth noting that, as with all lending markets, there may be extraordinary conditions, including critical failures in the underlying collateral, that may lead to temporary or permanent market illiquidity. Such conditions may adversely affect reUSD holders, Resupply stakeholders, and depositors to the Insurance Pool.

LlamaRisk actively monitors LlamaLend markets and works to ensure proper market operation that protects lenders to these markets.

Oracle

The oracle used in LlamaLend markets is a critical dependency and typically employs one or more Curve pool price oracles to derive a market price for the underlying. The sUSDS oracle contract can be found here.

This oracle uses the sUSDS/scrvUSD StableSwap-ng pool with current TVL of $6m. This TVL is sufficient to ensure a reliable price oracle, and the EMA pricing protects against price manipulation attempts.

The oracle also uses the sUSDS vault and the aggregated USD price of crvUSD. Using the aggregated price of crvUSD instead of crvUSD helps mitigate the risk of borrower liquidation in case crvUSD experiences a short-term upward depeg.