Summary:

Add the sdeUSD-long LlamaLend market with vault address 0xFA4f65B3Dc477738ce8618e9145E1f0Ad9E29034, allowing users to mint reUSD and leverage supply to the market.

Set the market with a max 95% LTV, 5% liquidation fee, and 6.5m reUSD max borrow.

Abstract:

The sdeUSD-long market has been configured similar to the sUSDe-long market, as they have similar properties with slight parameter changes based on simulation results. The sdeUSD-long market utilizes an oracle implementation that chains together 3 Curve pool price oracles, the sdeUSD vault, and the aggregated price of crvUSD. Notably, the sdeUSD/deUSD pool was recently seeded and was added to the gauge controller on 6/17/25.

sdeUSD Overview:

Elixir (s)deUSD Overview:

deUSD is a synthetic stablecoin backed by delta-neutral ETH positions, RWA assets, and USDS. A distinguishing feature of deUSD is the ability to mint deUSD using RWA assets (SCOPE and BUIDL) through S-token technology.

deUSD can be staked for sdeUSD which earns a portion of the rewards from protocol operations. sdeUSD is a non-rebasing, ERC-4626 token compatible with DeFi integrations. sdeUSD currently has an unstaking period of 7 days, but the sdeUSD contract allows for a maximum unstaking period of 90 days.

Collateral Management

To maintain the deUSD peg, a combination of delta-neutral ETH positions and USDS holdings are used as collateral. The current collateral backing of deUSD can be viewed here.

Delta-neutral ETH Positions

Delta-neutral ETH positions employ opening short perpetual future positions equal in value to the amount of ETH held to hedge against the price movements of ETH. These perpetual future positions utilize off-exchange settlement by Fireblocks. In off-exchange settlement, Fireblocks and Elixir have mutual custody over an on-chain multisig wallet which is used to settle the PnL on an exchange. This mitigates the counterparty risk of exchanges experiencing a hack or insolvency as funds are never directly held on an exchange. Currently, Elixir uses Bybit for perpetual future positions, but plans to expand to decentralized exchanges.

USDS Collateral

USDS is a stablecoin by Sky Protocol that is backed by a combination of stablecoins, RWAs, and crypto tokens. It utilizes a overcollateralization with the Peg Stability Module to help maintain its $1 peg. USDS can be staked into sUSDS to access the Sky Savings Rate which distributes yield back to sUSDS holders. The Sky Savings Rate is generated through numerous income streams such as USDS borrow fees, USDS loan liquidations, and RWA asset yield.

Elixir elects to stake all of its USDS into sUSDS to earn yield. There are plans to deploy idle sUSDS into Morpho vaults managed by Gauntlet and MEV Capital to earn additional yield.

Execution Buffer Fund

Elixir dynamically adjusts the collateralization of deUSD by changing the ratio of delta-neutral ETH positions to USDS depending on the funding rate yield. As funding rates decrease, delta-neutral ETH positions are shifted to USDS to continue to generate yield, even in negative funding rate environments. The Execution Buffer Fund (EBF) serves to cover execution costs that occur when switching between USDS and delta-neutral ETH positions.

RWA Asset Collateral

Currently, BUIDL and SCOPE are accepted as collateral for deUSD. BUIDL is custodied by Securitize and managed by Blackrock, backed by US cash, treasury bills, and repurchase agreements. SCOPE is custodied by Securitize and managed by Hamilton Lane, backed by senior secured loans. RWA assets are isolated as collateral and should not be affected by potential undercollateralization from USDS, or delta-neutral ETH positions.

Minting and Redemption Mechanics

At the moment, only whitelisted institutions and financial firms are able to mint and redeem deUSD, unless RWA assets are used. Traditional mints are done with stETH, while redemptions are done with USDT.

Users can deposit RWA S-tokens into Elixir to mint the equivalent amount of deUSD and subsequently redeem their RWA S-tokens.

Peg Stability

Source:Dune

The chart maps out the amount deUSD deviated from the $1 peg using minute price data since its launch. Overall, deUSD had a mean price of $1.0008 and a standard deviation of $0.0146. Comparatively, USDT has a mean price of $1.0004 and a standard deviation of $0.0005. USDe has a mean price of $1.0004 and a standard deviation of $0.00101.

Risk Management and Disclosures

Elixir has compiled a list of risks involved in using their protocol, available here.

Key risks involved and their mitigations include:

-

Smart Contract Risk

-

Risk: deUSD remains reliant on smart contracts for many functions. Minting, redeeming, staking, and yield generation all involve some smart contract risk.

-

Mitigation: Elixir has been audited multiple times by Trail of Bits and USDS has also been audited by ChainSecurity.

-

-

Collateral Risk

-

Risk: deUSD holds collateral in third-party tokens, namely stETH, USDS, BUIDL, and SCOPE. Unexpected loss of value in any of these tokens could lead to a potential undercollateralization of deUSD.

-

Mitigation: BUIDL and SCOPE are both heavily regulated RWA tokens. Both USDS and stETH have a good security record and employ strong security measures.

-

-

Counterparty Risk

-

Risk: Insolvency of a perpetual venue could lead to a potential undercollateralization of deUSD.

-

Mitigation: Fireblocks is used for off-chain exchange settlement. However, Elixir should consider diversifying exchange usage beyond ByBit.

-

Specification:

Parameter Optimization Methodology

The sdeUSD market parameters were determined by analyzing comparable yield-bearing stablecoin markets including sUSDe, sfrxUSD, sDOLA, and sUSDS, then optimizing the debt ceiling based on this analysis. The methodology centered on ensuring oracle manipulation attack costs exceed potential profits across various debt scenarios while maintaining competitive market positioning. Additionally, the approach prioritized constraining the debt ceiling to adhere to the available liquidity for liquidations in stress scenarios.

The debt ceiling analysis incorporated real sdeUSD-to-crvUSD conversion path data, borrower data inherited from similar markets, and conservative liquidatable debt assumptions to balance market attractiveness with necessary security margins.

Market Parameters

| Parameter | Value |

|---|---|

| A (Band Width Factor) | 200 |

| AMM Swap Fee | 0.6% |

| Liquidation Discount | 1.5% |

| Loan Discount | 1.9% |

The 97% maximum LTV targets a competitive position close to sUSDe’s 96.73%, recognizing the similar functionality between these yield-bearing stablecoin markets. This positioning balances borrower attractiveness with necessary risk management.

The 1.9% loan discount directly matches the sUSDe market structure. The 1.5% liquidation discount ensures liquidators receive sufficient compensation to maintain active participation in the liquidation process. The 1x buffer framework (derived through the competitive analysis of like markets) means that when positions reach maximum LTV (97%), they still maintain a 1.5% (same as liquidation discount) cushion before reaching the LTV of 98.5% beyond which the liquidator’s profit starts to reduce.

The amplification factor of 200 follows sUSDe precedent and supports the target max LTV of 97%. This complete configuration has been validated against similar markets including sUSDe, sfrxUSD, sDOLA, and sUSDS.

Monetary Policy

| Parameter | Value |

|---|---|

| Min Rate | 0.1% |

| Max Rate | 22% |

The market uses Semilog Monetary Policy, the current standard for LlamaLend Markets. This policy uses a polynomial curve based on the market utilization and the min/max rates set by governance. The parameter config has been set with a slightly lower max rate compared to other yield-bearing stable markets and is intended to exceed the expected yield on the underlying, thereby protecting lenders against market illquidity. The 3 month high for sdeUSD APY has never reached over 10% (reaching highs of 9.19% in late-July), making the max rate of 22% reasonable.

Source:Elixir Dashboard, August 27th, 2025

Oracle

Proxy: https://etherscan.io/address/0x65915688eAB462F16220Fc9060C35b7308d19Af3

Implementation: https://etherscan.io/address/0xfC996df15aAc3e50FFC0a76F0A2Ca2F1B7243855

In line with the deployment of recent LlamaLend markets, the implementation of an oracle proxy allows the Curve DAO to set a new oracle implementation without requiring a market migration. The implementation CryptoFromPoolsVaultsWAgg is an oracle that chains multiple Curve pool price oracles with an ERC-4626 vault and the aggregated price of crvUSD.

The underlying pools and contracts used in the oracle include:

-

sdeUSD/deUSD: $2.6m TVL

-

deUSD/USDC: $16.6m TVL

-

USDC/crvUSD: $17.2m TVL

The TVL history for each of the pools used in the oracle implementation are shown:

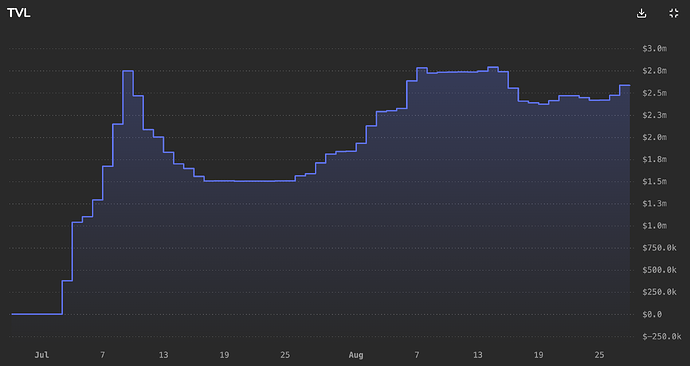

sdeUSD/deUSD

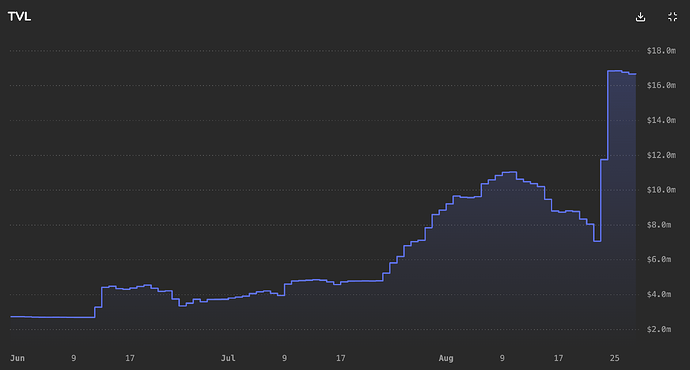

deUSD/USDC

crvUSD/USDC

Source: CurveMonitor

The use of aggregated price of crvUSD improves the resiliency of the market to instances of transient crvUSD depeg in the constituent pools. This reduces the probability that users can be liquidated as a result of crvUSD price deviations.

Debt Ceiling

We recommend a $6.5M debt ceiling based on our simulation and liquidity assessments. This ceiling is determined by multiple constraint factors that work together to ensure market safety and efficiency.

From analysis we conducted in July, oracle manipulation attacks remained unprofitable up to $8M in expected debt, providing substantial margins above the recommended ceiling. The 3-pool chain increases the surface area of potential weakness in the oracle pricing, necessitating a more conservative exposure limit. To reduce susceptibility further, increased liquidity in the sdeUSD/deUSD pool is essential.

The market’s liquidity constraints demonstrate that it can absorb significant liquidation volumes with manageable price impact during stress scenarios. The current sdeUSD-to-crvUSD conversion path supports liquidation processing requirements, with the liquidity ceiling computed based on available market depth at liquidation discount levels.